2020. 3. 11. 05:27ㆍ카테고리 없음

Intuit Quicken 2017 Deluxe Crack Full Version for Win + Mac Intuit Quicken 2017 Deluxe Crack Intuit Quicken 2017 Deluxe Crack Full Version is a finance that might be the device that enables that are effective to manage your funds, bill pay, credit rating, budgeting and investing that is complete will need to get an overview that is quick of dollars you must show up and go out. Intuit Quicken 2017 Deluxe 26.1.1.5 R1 permits you to take care of your targets which could be monetary whether investing bills, living costs, utility bill, lending options, kid’s training, travel, leisure, and more. Also, Quicken 2017 Deluxe can save you yourself frequently improve control of the funds. Quicken was around for nearly a quarter of a century. It nevertheless dominates the field while it has rivals in the personal finance administration space, such as Personal Capital and Mint.com in the cloud and Moneydance on the desktop.

Quite simply, Quicken helps you manage every element of your finances that are personal account management, spending, bills, preparing, spending, and property/debt. The most significant enhancement in the Quicken 2017 lineup is a redesigned user interface, which is an improvement that is welcome.

Its many tools are saved a little more neatly, yet are easily accessible, for the component that is most. Advance features:.

There are four versions of Quicken 2017, each of which enhances the functionality based on the past one. Quicken Starter Edition expense and income management, budgeting, and bill-pay. Quicken Deluxe, for $74.99,. adds features like your retirement planning and an enhanced app that is mobile. At $109.99,. Quicken Premier includes advanced level tools that are investment-tracking. And $119.99,.

How Due I View All Scheduled Transactions In Quicken 2017 For Mac Pro

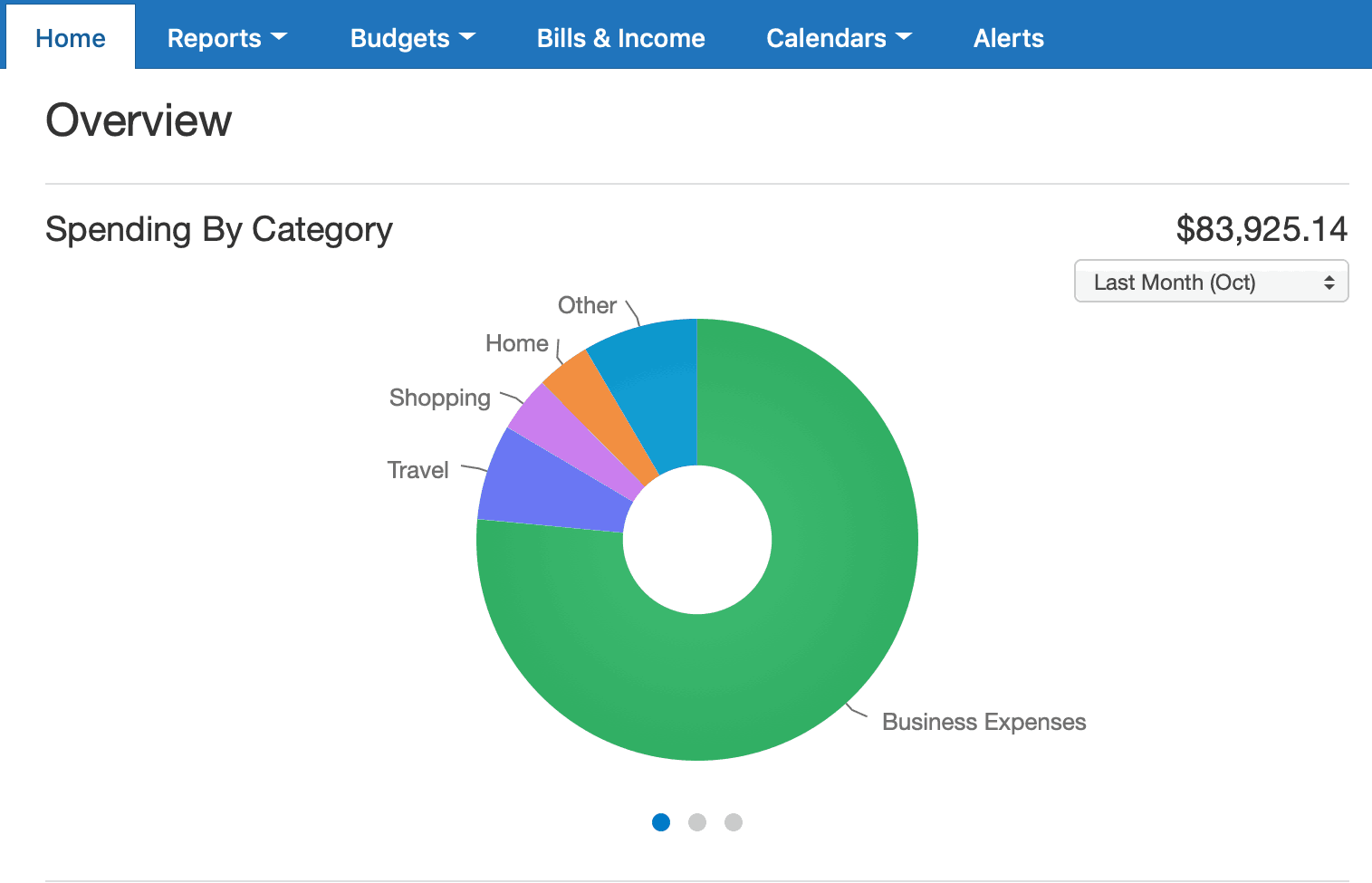

Quicken Home & Business would be the option that is perfect for a sole proprietor who requires transaction categorization (for income taxes), profit/loss projections, and cash flow reports.I looked at Quicken Home & Business to make confident that I could report on the ongoing service as a whole. New Look, Navigation. As with other software that is financial Quicken’s house page is a dashboard that displays your most significant numbers in both table and chart form. You can personalize the default view and create multiple versions of it containing different products from the set of a dozen that is few, like All accounts, Calendar, Income vs. Expenses, Portfolio Value Graph, and Tax-Related Expenses YTD. The left pane that is vertical your account balances; you can change this down if you like. There are two main options for navigating involving the program’s primary sections.

You can click on some of a set of tabs that are presented horizontally on the screen that main gets to areas like Spending, Bills, Investing, and Property & Debt. Or you can turn on standard Windows drop-down menus that find the top that is extremely of the page. Click Bills, for instance, and three links that are navigational above the primary data display:. Online Bills, Bill Reminders, and Projected Balances. The Bill Reminders table is an inventory of all of the reminders you’ve set up, along with their status (Overdue, Upcoming, Auto, and therefore on) and action buttons that let you enter and modify them.

That is how Quicken works throughout, like a Windows system that uses navigation that is standard. It’s easy enough to learn and use, and possesses enhanced, but it nevertheless has an old aesthetic. Some tools pop out in brand new windows instead of being seamlessly integrated, and there’s a mix that is uncomfortable of- and new-looking screens. It has though the features have just been tacked on over the years.

And I also guess that US customers who would use the majority of those features are in the minority. Review: the program will move cleared transactions to the appropriate registers (you may also enter transactions manually). This list view can include transactions from all accounts, or you can look at them individually. The date range for every single register is you could designate to transactions. It is possible to create your very own. However, it’s critical you use the income that is official categories for those deals you will desire to report on your taxes.

The payoff with this information work is available in the form of a large chart that is colorful causes it to be clear where all of your hard earned money comes from and where you are spending it. Review: You can find other tools available to assist you to monitor your accounts. Quicken provides a reconciliation that is simple, for starters. And when you go through the Action symbol into the right that is upper you’ll see a whole menu of related tasks you could access from here. You can, as an example, write checks and export data to Excel, and create reports.There is numerous finance that is individual that automate a subset of the tasks that Quicken does.

LearnVest is one. You can track income and expenses to learn about your investing habits and produce better budgets.

It also helps you find ways to meet up with your targets that are monetary like an exploration of the options for repaying credit debt.Other applications perform one function that is primary nevertheless they do it well. WalletHub, for instance, helps you monitor and analyze your credit score. Review: Among the things that are first I’ll do as you’re establishing Quicken (after you’ve created or entered your Intuit ID) is to connect to at least one bank account. You can include more kinds of connections later, but you will probably want, to begin with the account you’ll use to pay bills. There are three choices for this regard. You can manually download files from your financial institution or set up an update option that is automatic. To pay bills and move money from Quicken, you’re going to be necessary to use Connect that is right bank may charge a fee because of this on top of Quicken’s $9.95 each month fee.

Review: Quicken provides two alternatives for paying bills. You can cause a draft law by providing the details that are key this then automatically can become a bill reminder and seems on the list alongside its status (upcoming, automatically entered, etc.). You can connect to it, and its amount and date due are immediately updated whenever that information becomes available if you have a login for a biller’s website. All outgoing and transactions that are incoming all records can be exported and imported when you launch Quicken’s One-Step Update Includes everything in Starter plus:. Plan money for hard times waiting for you. Create a plan to settle obligation that is financial save yourself for future years.

See how need that is much is you’ll save to reach your-your retirement goals.